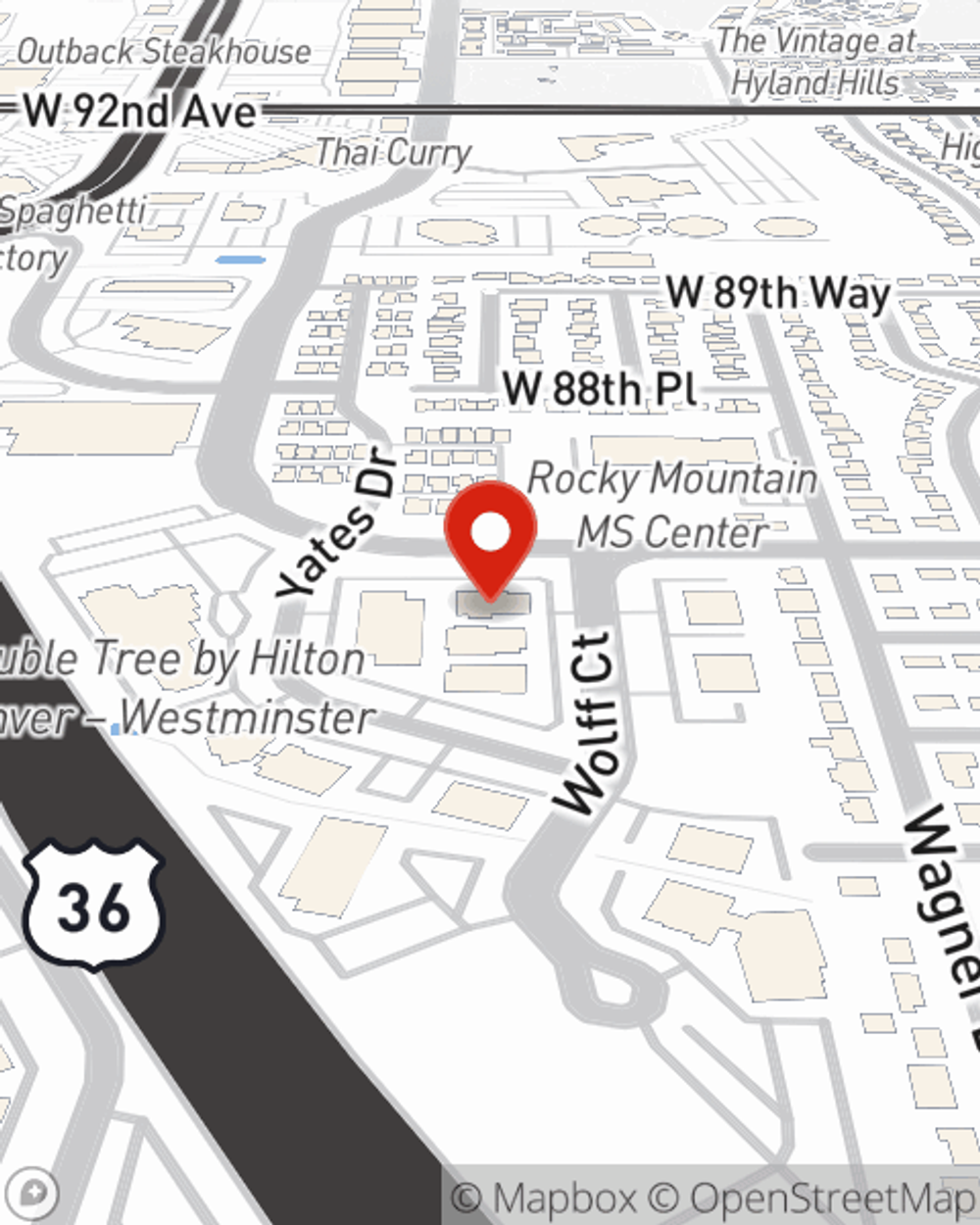

Business Insurance in and around Westminster

Looking for insurance for your business? Look no further than State Farm agent Ken Kearney!

Almost 100 years of helping small businesses

This Coverage Is Worth It.

Worries are unavoidable when you own a small business. You want to make sure your business and everyone connected to it are covered in the event of some unexpected trouble or catastrophe. And you also want to care for any staff and customers who become injured on your property.

Looking for insurance for your business? Look no further than State Farm agent Ken Kearney!

Almost 100 years of helping small businesses

Cover Your Business Assets

No one knows what tomorrow will bring—especially in the business world. Since even your most detailed plans can't predict natural disasters or global catastrophes. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for protection with a State Farm small business policy. Business insurance is necessary for many reasons. It protects your hard work with coverage like extra liability and errors and omissions liability. Fantastic coverage like this is why Westminster business owners choose State Farm insurance. State Farm agent Ken Kearney can help design a policy for the level of coverage you have in mind. If troubles find you, Ken Kearney can be there to help you file your claim and help your business life go right again.

Don’t let the unknown about your business keep you up at night! Call or email State Farm agent Ken Kearney today, and learn more about how you can benefit from State Farm small business insurance.

Simple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Ken Kearney

State Farm® Insurance AgentSimple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.